In an era where economic landscapes are ever-shifting, central banks find themselves standing at a pivotal crossroads, facing decisions that will define the future of monetary policy. “Now or Never: Central Banks at the Crossroads of Change” delves deep into the intricate balance of maintaining stability while embracing innovation. As inflation rates fluctuate and global uncertainties loom, these financial powerhouses must navigate a complex terrain marked by technological advancements, changing consumer behaviors, and the urgent call for sustainable practices. This article explores the dynamics at play, examining how central banks can adapt and evolve in real-time, ensuring that they are not just reactive, but proactive in shaping a resilient economic future. Join us as we unpack the challenges and opportunities that lie ahead, illuminating the critical choices that will determine the trajectory of monetary governance in the 21st century.

Central Banks and the Digital Currency Revolution

The world of finance stands on the brink of a transformative era as central banks explore the intricate possibilities of digital currencies. These institutions, historically conservative in their approach, are now compelled to meet the challenges posed by rapid technological advancements and evolving consumer behaviors. As public demand for faster payment methods and increased financial security rises, the adoption of Central Bank Digital Currencies (CBDCs) emerges not just as an innovation but as a vital necessity. With the potential to enhance payment efficiency, reduce costs, and circumvent potential crises in the traditional banking system, the digital currency landscape beckons central banks to rethink their roles and responsibilities within the global economy.

However, this revolution is not without its complexities. Central banks must confront a myriad of challenges including regulatory frameworks, privacy concerns, and the overarching question of financial inclusion. As they tread this uncharted territory, central banks are evaluating various models for implementation, each drawing from different international precedents. While some favor a more centralized approach, others are contemplating a system that embraces a degree of decentralization to stimulate innovation without sacrificing control. The decisions made in this pivotal moment will dictate the future trajectory of monetary policy and financial stability across the globe.

| Key Aspects of CBDCs | Potential Benefits |

|---|---|

| Increased Efficiency | Faster transaction speeds and lower transaction costs |

| Enhanced Security | Reduced risks of fraud and counterfeiting |

| Financial Inclusion | Access for unbanked populations, promoting economic participation |

| Monetary Policy Control | Direct influence on money supply and interest rates |

| Cross-border Transactions | Streamlined international trade and remittance processes |

Navigating Inflationary Pressures in a Post-Pandemic World

As economies rebound from the disruptions of the pandemic, central banks are confronted with the intricate task of balancing recovery with the looming shadow of inflation. The unprecedented fiscal measures and supply chain bottlenecks have created a unique concoction of demand and cost pressures that challenge traditional monetary policies. To navigate this, central banks must assess various tools and strategies, including interest rate adjustments, quantitative tightening, and forward guidance, ensuring they stay ahead of market expectations while fostering sustainable growth. The delicate act of steering economies away from stagnation without igniting runaway inflation could define monetary policy for years to come.

To reshape their response, central banks are not only analyzing current data but also re-evaluating their frameworks. A shift toward strategies that prioritize flexible inflation targeting might be necessary. Key considerations include:

- Adaptive learning models to incorporate real-time economic changes.

- Enhanced communication strategies to manage public perception and expectations.

- Collaboration with fiscal authorities for a holistic approach to economic recovery.

Furthermore, understanding how global dynamics influence local economies will be crucial. Analyzing indicators such as supply chain resilience, labor market shifts, and consumer behavior can provide insights into potential inflationary trends. Below is a simplified table of potential inflation triggers and their implications:

| Inflation Trigger | Potential Implication |

|---|---|

| Supply Chain Disruptions | Increased prices due to scarcity of goods |

| Consumer Demand Surge | Higher inflation as spending outpaces supply |

| Labor Shortages | Wage inflation leading to increased production costs |

The Role of Transparency and Communication in Monetary Policy

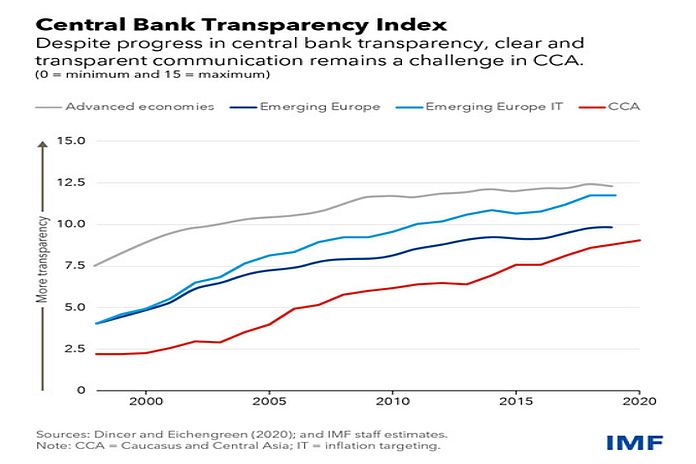

In recent years, central banks have recognized that transparency and communication are integral to effectively managing economic expectations and enhancing policy efficacy. By clearly articulating their goals, strategies, and anticipated actions, central banks can build stronger trust with both the public and market participants. This openness fosters a more predictable economic environment, thus reducing volatility. Key aspects of communication include:

- Forward guidance: Providing insights into future policy intentions.

- Regular updates: Keeping stakeholders informed about economic assessments.

- Q&A sessions: Engaging with the public and answering queries to demystify complex decisions.

Moreover, the implementation of structured communication frameworks has proven particularly effective. By using a variety of media, including social platforms, press releases, and public speeches, central banks can tailor their messages to different audiences, ensuring broader comprehension. A comprehensive approach to communication supports the synchronization of expectations, which is paramount in times of economic uncertainty. The following table highlights successful transparency initiatives by various central banks:

| Central Bank | Initiative | Impact |

|---|---|---|

| Federal Reserve | Quarterly economic projections | Enhanced forecasting accuracy |

| European Central Bank | Press conferences after policy meetings | Improved market responses |

| Bank of England | Inflation reports dissemination | Increased public understanding |

Fostering Economic Resilience Through Innovative Financial Tools

In an era marked by financial uncertainty and rapidly changing economic landscapes, innovative financial tools are emerging as vital mechanisms for enhancing resilience in both individuals and businesses. Central banks are uniquely positioned to lead this transformation by integrating digital currencies and decentralized finance into traditional monetary frameworks. Such tools not only democratize access to financial resources but also streamline transactions, enabling faster responses to economic shocks. The adoption of technologies like blockchain, artificial intelligence, and predictive analytics can further empower institutions to tailor solutions that meet the specific needs of their communities.

To capitalize on these innovations, extensive collaboration among stakeholders—governments, private sectors, and civil society—will be essential. Identifying key opportunities and challenges related to digital finance can help shape a more inclusive financial ecosystem. Here are some primary areas to consider:

- Accessibility: Enhancing financial inclusion for marginalized communities.

- Transparency: Building trust through clear regulatory frameworks.

- Security: Mitigating risks associated with cyber threats.

- Sustainability: Promoting green finance and sustainable investments.

The table below illustrates potential financial tools and their respective benefits:

| Financial Tool | Benefits |

|---|---|

| Digital Currencies | Faster transactions and lower fees |

| Peer-to-Peer Lending | Increased access to credit |

| Crowdfunding Platforms | Support for entrepreneurial ventures |

| Smart Contracts | Automated, trustless agreements |

Future Outlook

As we stand at this pivotal crossroads of monetary policy and economic evolution, the decisions made by central banks will resonate far beyond the confines of traditional finance. The unfolding narrative of “Now or Never” encapsulates the urgency of our times, demanding innovative strategies to navigate the challenges and opportunities that lie ahead.

With the world’s economies teetering on the brink of transformation—driven by technological advancements, shifting demographics, and global crises—the role of central banks has never been more crucial. As these institutions strive to reimagine their frameworks, they find themselves balancing the age-old tenets of stability and growth with the pressing need for adaptability in a rapidly changing landscape.

The journey forward will not be without its hurdles. Yet, it is precisely in this moment of uncertainty that we may discover new pathways to resilience and prosperity. As the architects of monetary policy grapple with the complexity of our interconnected world, the stakes are high, and the time for decisive action is now.

the choices made today will shape the financial systems of tomorrow. As we watch this critical chapter unfold, we are reminded that while the future remains unwritten, the actions we take—or fail to take—will be the ink that guides our shared economic destiny.